net investment income tax 2021 trusts

1 It applies to individuals families estates and trusts. 2021 Georgia Code Title 48 - Revenue and Taxation Chapter 7 - Income Taxes Article 2 - Imposition Rate Computation Exemptions and.

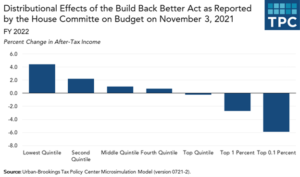

The Build Back Better Plan Save Your Tax Dollars Before The Year S End Altfest

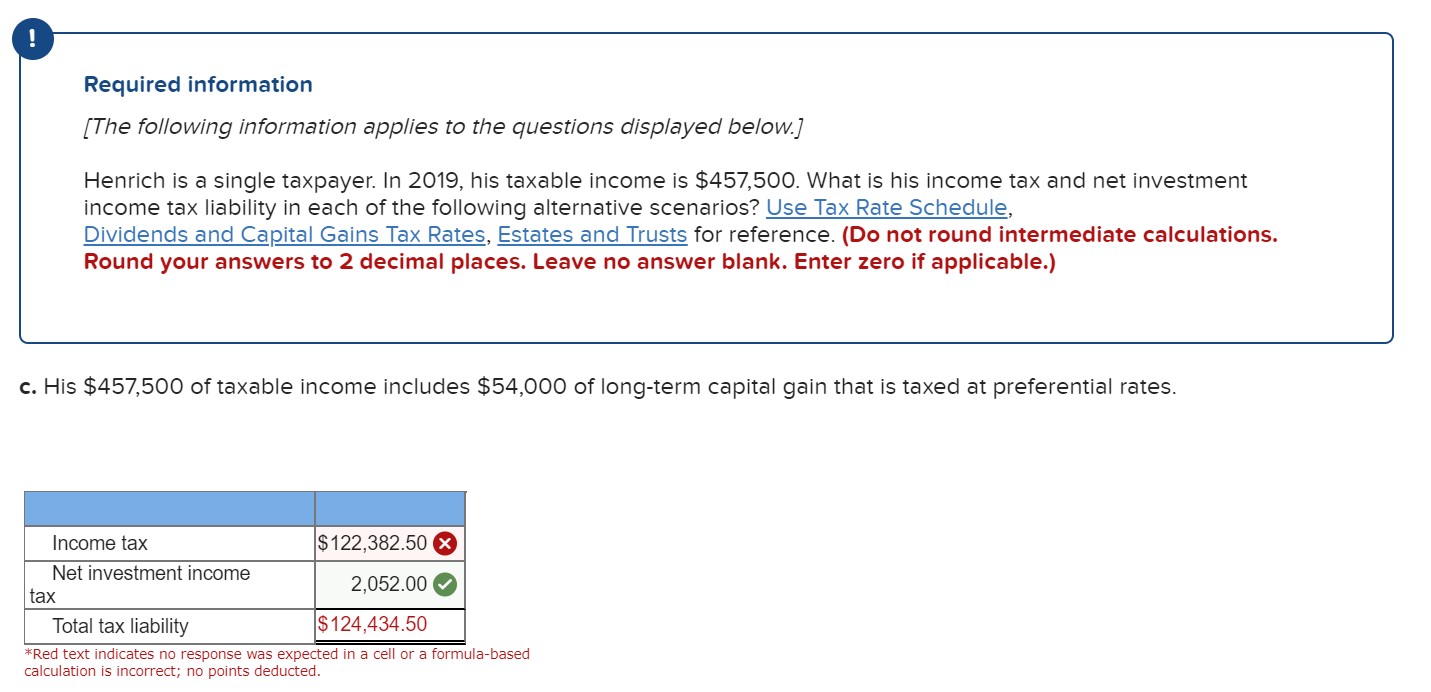

The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers.

. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted. Effective January 1 2013 Code Sec. The net investment income tax is equal to 38 of the lesser of the taxpayers 1 net investment income for the tax year or 2 the excess if any of the MAGI for the tax year.

Generally net investment income includes gross income from interest dividends annuities and royalties. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income. The Net Investment Income Tax does not apply to any amount of gain that is excluded from gross income for regular income tax purposes 250000 for single filers and.

Justia Free Databases of US Laws Codes Statutes. The estates or trusts portion of net investment income tax is calculated on Form. As a result any net investment income generated by the trust is included in the grantors net investment income potentially subject to the 38 tax at the individual level.

Since the modified adjusted gross income exceeds the threshold amount of 200000 for single taxpayers by 90000 while the net investment income is 120000 the. Since this amount is more than the limit by 209055 - 200000 9055 the individual will pay net investment income tax of 38 x 9055 34409. April 28 2021 The 38 Net Investment Income Tax.

Retained in the trust will be subject to the high trust tax rates including the 38 tax on trust net investment income that applies above the MAGI threshold only 13050 for 2021. The NII tax does not. 1411 imposes the 38-percent Net Investment Income Tax NIIT on the net investment income of individuals trusts and estates.

Propublica Shows How Little The Wealthiest Pay In Taxes Policymakers Should Respond Accordingly Center On Budget And Policy Priorities

2021 Tax Rates And Exemption Amounts For Estates And Trusts Preservation Family Wealth Protection Planning

Net Investment Income Tax Niit Quick Guides Asena Advisors

Trust Tax Rates And Exemptions For 2022 Smartasset

Solved You Are Working As An Accountant At A Mid Size Cpa Firm One Of Your Clients Is Bob Jones Bob S Personal Information Is As Follows October Course Hero

What You Need To Know About Capital Gains Tax

3 8 Net Investment Income Tax Td T

9 Ways To Reduce Your Taxable Income Fidelity Charitable

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

How To Calculate The Net Investment Income Properly

How To Calculate The Net Investment Income Properly

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust

Income Taxation Of Trusts And Estates After Tax Reform

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

What Is The Net Investment Income Tax And Who Has To Pay It Bankrate

Trusts Estates And The Net Investment Income Tax Withum

/4592-f64c21a16a3847538c094ee48dee34fe.jpg)