osceola county property tax rate

OSCEOLA COUNTY TAX COLLECTOR. The median property tax on a 19920000 house is 209160 in the United States.

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden

Economic Development Commission 300 7th Street Sibley Iowa 51249 712 754-2523.

. Learn how Osceola County levies its real property taxes with our detailed review. 407-742-3995 Driver License Tag FAX. Get bills by email.

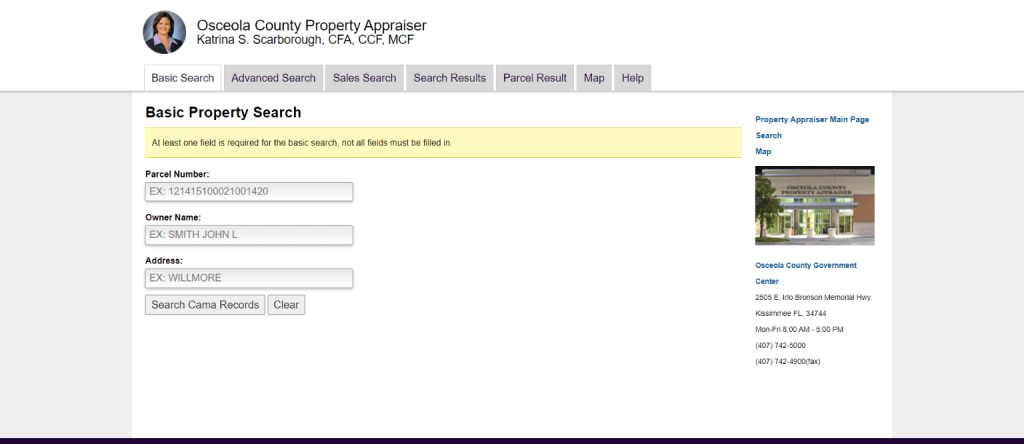

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart. Osceola County Tax Collector Property Search. The median property tax also known as real estate tax in Osceola County is 73400 per year based on a median home value of 7020000 and a median effective property tax rate of 105 of property value.

407-742-4009 Local BusinessTourist Tax Read More FAX. Iowa is ranked 1978th of the 3143 counties in the United States in order of the median amount of property taxes collected. Search and Pay Property Tax.

The following are some of the protocols that have been put in place to ensure the safety of our staff and our customers 2019 TAX BILL INFORMATION OSCEOLA COUNTY TAX COLLECTOR 2019 OSCEOLA COUNTY PROPERTY TAX The enclosed tax notice covers ad valorem taxes for the calendar year January 1 2019 through December 31 2019 and non-ad. Osceola County collects on average 114 of a propertys assessed fair market value as property tax. If you are considering becoming a resident or only planning to invest in the countys real estate youll come to know whether Osceola County property tax regulations are helpful for you or youd rather look for another location.

Taxpayers may choose to pay their property taxes quarterly by participating in an installment payment plan. With market values established Osceola along with other in-county public bodies will calculate tax rates independently. The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of 095 of property value.

To be eligible for the program the taxpayers estimated taxes must be in excess of 10000. Florida provides taxpayers with a variety of exemptions that may lower propertys tax bill. If you are contemplating taking up residence there or only planning to invest in Osceola County property youll learn whether the countys property tax laws are helpful for.

Under Florida law e-mail addresses are public records. Michigan is ranked 1239th of the 3143 counties in the United States in order of the median amount of property. 407-742-4037 Property Taxes FAX.

Want to get your bills by email. Osceola Property Collector Tax County Search. 407-742-4009 Local BusinessTourist Tax.

Use the search box below to locate your account and then click the Get Bills by Email link. Irlo Bronson Memorial Hwy. Pay Tourist Tax.

Yearly median tax in Osceola County. This property is fully exempted from paying taxes. With this resource you will learn helpful knowledge about Osceola County property taxes and get a better understanding of things to consider when it is time to pay.

You can use the Michigan property tax map to the left to compare Osceola Countys property tax to other counties in Michigan. Osceola County Courthouse 300 7th Street Sibley Iowa 51249 712 754-2241. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email.

If you do not want your e-mail address released in response to a public records request do not send electronic mail to this entity. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart. Osceola County collects on average 105 of a propertys assessed fair market value as property tax.

Osceola Tax Collector Website. The Tax Collectors Office provides the following services. Current tax represents the amount the present owner pays including exemptions.

When added together the property tax burden all taxpayers support is created. In this basic budgetary function county and. 407-742-4037 Property Taxes FAX.

Visit their website for more information. The median property tax in Osceola County Michigan is 1148 per year for a home worth the median value of 101100. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar.

Osceola County Florida Property Search. The median property tax on a 19920000 house is 189240 in Osceola County. The median property tax in Osceola County Iowa is 734 per year for a home worth the median value of 70200.

The median property tax also known as real estate tax in Osceola County is 114800 per year based on a median home value of 10110000 and a median effective property tax rate of 114 of property value. Search all services we offer. The median property tax on a 19920000 house is 193224 in Florida.

Washtenaw County collects the highest property tax in Michigan levying an average of 181 of median home value yearly in property taxes while Luce County has the lowest property tax in the state collecting an average tax of 73900 086 of median. Search and Pay Business Tax. These are deducted from the assessed value to give the propertys taxable value.

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Fl Property Tax Search And Records Propertyshark

Osceola County Fl Property Tax Search And Records Propertyshark

Property Tax Search Taxsys Osceola County Tax Collector

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf

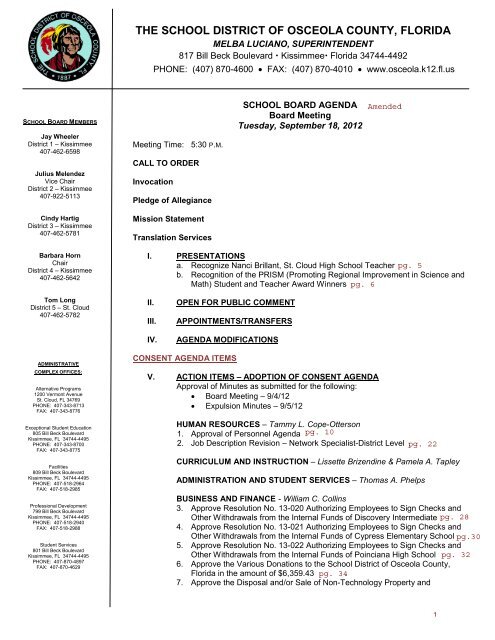

Curriculum Amp Instruction Consent Agenda Osceola County School

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf

Osceola County Ordinance 00 13 Indian Wells Hoa

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf

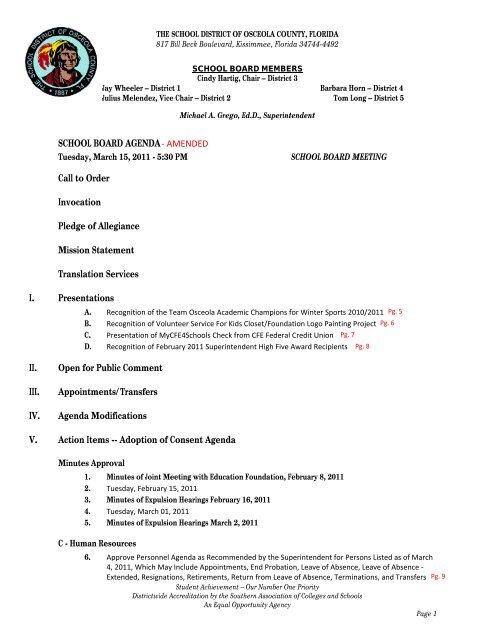

Agenda Tuesday March 15 2011 Osceola County School District

Osceola County Property Appraiser How To Check Your Property S Value

2022 Best Places To Buy A House In Osceola County Fl Niche

Osceola County Property Appraiser How To Check Your Property S Value